The Haradh III development at the southern tip of the Ghawar oil field in Saudi Arabia, completed in 2006, has been portrayed by the national oil company Saudi Aramco as the turning point in the battle between geological adversity and engineering prowess. The poorest reservoir rock in Ghawar has succumbed to the latest in well and drilling technology. Aided by 3D Seismic images showing fracture locations, well sites were optimized and drills were guided by remote control from Dhahran. Smart completions were standard (did they ever call them "dumb" completions?), and something called an "iField" was set up. Maximum-reservoir-connectivity wells (MRCs) were fitted with monitoring electronics and valves on individual laterals such that they could be throttled back as needed to minimize water encroachment. Testing was done, adjustments were made as needed, and everything rolled out ahead of schedule. Goals for individual well productivity of 10,000 barrels/day were met, and projections indicated smooth sailing for ten years or more. Lots of glowing articles were published, and the man in charge eventually rode off in glory to solve the rest of the world's oil production problems.

The Haradh III development at the southern tip of the Ghawar oil field in Saudi Arabia, completed in 2006, has been portrayed by the national oil company Saudi Aramco as the turning point in the battle between geological adversity and engineering prowess. The poorest reservoir rock in Ghawar has succumbed to the latest in well and drilling technology. Aided by 3D Seismic images showing fracture locations, well sites were optimized and drills were guided by remote control from Dhahran. Smart completions were standard (did they ever call them "dumb" completions?), and something called an "iField" was set up. Maximum-reservoir-connectivity wells (MRCs) were fitted with monitoring electronics and valves on individual laterals such that they could be throttled back as needed to minimize water encroachment. Testing was done, adjustments were made as needed, and everything rolled out ahead of schedule. Goals for individual well productivity of 10,000 barrels/day were met, and projections indicated smooth sailing for ten years or more. Lots of glowing articles were published, and the man in charge eventually rode off in glory to solve the rest of the world's oil production problems.

Funny thing, though. When you look at a satellite photo and count the number of producer wells they ended up drilling, it adds up to quite a few more than they have been claiming -- about 60% more.

There must be a reasonable explanation. Perhaps they simply miscounted.

Faux Pas in the Desert

OK, so what's the big deal? After all, what are a few extra wells? But Saudi Aramco has been rather consistent, as well as thorough, about the development details:

The Haradh III project came on stream in February 2006, adding 300,000 B/D of Arabian light crude production capacity to Ghawar, the world’s largest oil field. The project’s main significance, however, derives from the fact that it sets a milestone for smart technologies at a scale and complexity unprecedented for Saudi Aramco and, arguably, for the industry. Haradh III might be regarded as the entry point to a new era in upstream projects and specifically into the domain of real-time reservoir management. The project spanned a period of 21 months. It entailed construction of a grassroots surface-facility network, integrated with a complex subsurface development program. Maximum-reservoir-contact (MRC) wells, smart completions, geosteering, and i-field features provided the four main technology components.

From the table at below, taken from the above paper, it seems that the new era features a lot more acronyms:

|

Figure 1a. Project specification and well layout for Haradh-III from Saudi Aramco |

A key figure is the number of producers (32). Also interesting is that the figures of 300,000 barrel/day flow and 2% depletion of reserves implies 5.475 billion barrels reserves in Haradh III(of course, this oil is not really physically separate from the rest of Haradh oil).

The well placement map below, from the same paper, shows how these wells were positioned to drain the field, aided by water injection from the periphery. The map also indicates 32 producers and 28 injectors, but with 15 instead of the 12 observation wells (EV/OBS) enumerated in the table.

|

Figure 1b. Project specification and well layout for Haradh-III from Saudi Aramco |

The above article was written by Nansen Saleri, the former Reservoir Manager for Saudi Aramco. He leveraged the success of this project to kick-start his new career as a reservoir engineering consultant. He later authored another article on Haradh-III, with a title invoking Matt Simmons' book "Twilight in the Desert" (egad!):

Dawn in the Desert

Against a backdrop of many international upstream projects straining to achieve their target production levels and intended plateaus, Haradh III reached its planned production capacity of 300,000 barrels per day well ahead of schedule, and the field’s performance more than 18 months since its start-up exceeds virtually all pre-project goals.

Sounds great, and he even provided some production data:

|

Figure 2. Early production data for Haradh-III from Saudi Aramco |

So, how are the wells doing?

Haradh III became the first Saudi Aramco project to be developed exclusively with MRC wells, with down-hole ICVs for flow control. Average well-production rates were targeted to be 10,000 bpd (which was achieved), compared with 3,000 bpd for Haradh I and 6,000 bpd for Haradh II.

...

The principal sub-surface challenges and their pre-project risks (premature water breakthrough, loss of oil production, high-decline rates) were for the most part managed. Eighteen months after initial production on January 31, 2006, the field is maintaining its production capacity at 300,000 bpd, at virtually no water production, and with 100 percent active status for all its initial producers.

While we can't double check the flow measurements, we can count wells. I took a look at the Haradh-III development project a couple years back to determine if the field was laid out they claim. Satellite imagery from Google Earth was used to identify and count wells to check against those reported. Unfortunately, most of the southern end of Ghawar was covered by high resolution imagery only as recent as 2004 (i.e. prior to the Haradh III project). Some 2006 low resolution imagery was available, and this plus the fortuitous location of a few wells on the eastern fringe (where there were 2006 hi-res pictures) gave a reasonable indication that the project was as advertised. Another complication is the large number of gas wells present in that region, and gas and oil wells can be distinguished only at high resolution. So a definitive assessment would have to wait.

See Satellite o'er the Desert and selected stories on The Oil Drum for more background on this and subsequent work on visually characterizing the oil fields of Saudi Arabia.

Fast Forward to 2009

Over the last two years, Google had updated the imagery for the rest of Ghawar such that everything was covered by mid-2006 imagery or later. The southern tip, however, was still stuck in 2004. But late in 2009, a handful of restricted locations across Saudi Arabia were updated with imagery only a couple months old, including pictures covering the lower two thirds of the Haradh and the northern half of the Hawiyah operational areas of Ghawar. These pictures were taken with the new GeoEye satellite. This imagery update was greatly appreciated, as 2006 is fading quickly into the ancient past. Also new in Google Earth is a timeline feature which makes available the archived imagery for easy comparison with the current view.

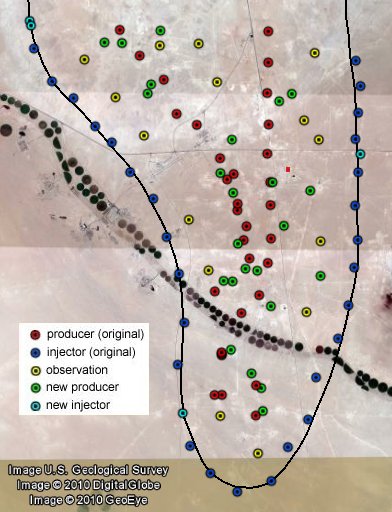

The new imagery shows that the locations for the producer, injector, and observation wells given in the well layout map from Saudi Aramco roughly match those found in the satellite image, as shown below (more your cursor over the image to overlay the well map). The trio of closely-spaced wells towards the southern end of the well diagram correspond to three actual wells spaced about 100 meters apart north to south. One producer is slightly displaced, as are some of the observation wells; but overall, the rendering is fairly accurate -- after one corrects for the "squishing" of the map, something that Saudi Aramco seems to do with many of their maps (perhaps to confuse us).

Figure 3. Haradh-III wells which Saudi Aramco admits to. Mouseover overlays Saudi Aramco well placement diagram. Click reveals additional wells seen in Aug-Sept 2009 imagery. |

However, there are many other new (non-gas) wells visible in the satellite images than those claimed. Shown in the figure below (or by clicking on the figure above) are locations of 28 additional wells. Based on their location, four of these are identified as injectors (light blue placemarks). Of those remaining (green placemarks), two are most likely observation wells, leaving 22 possible new producers. Two of the indicated sites do not yet have wells drilled, even though they most likely will, so a very conservative estimate is that 20 more producers have been drilled than reported by Saudi Aramco.

|

Figure 4. All visible wells which are part of the Haradh-III project (September 2009) |

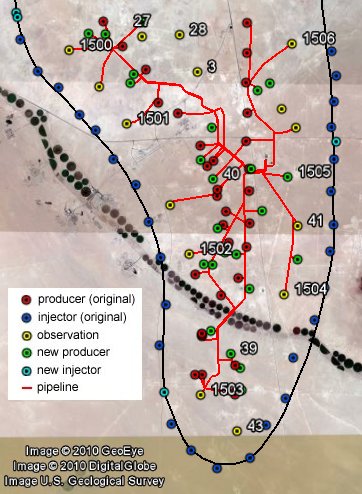

Using a variety of Ghawar well maps, I have determined the numerical identities for many of the wells. These are indicated in the figure below. Five of the observation wells (nos. 3, 27, 28, 41, and 43) were originally vertical wells drilled prior to 1990. Seven additional observation wells (1500-1506) were drilled at the start of the Haradh-III project. Interestingly, two of the "new" wells are actually old vertical well sites, shown as abandoned in 2004 imagery, and now presumably redrilled with horizontal sidetracks. Further confirmation of the identity of these wells as oil producers is the observation that they are connected to the same pipeline network with feeds into the Haradh-III Gas Oil Separation Plant, as shown below with the red traces.

|

Figure 5. Haradh-III oil pipeline network and identities of several wells |

Note that most of the observation wells are also connected to the pipeline network, and wells 3, 27, and 28 are connected to the pipeline network for the Haradh-II GOSP further north.

One detail remaining to be answered is the timing; when, since early 2006, were the additional wells drilled? DigitalGlobe, one of the imagery providers for Google Earth, has mid-2006-2007 images covering most of Haradh, but GE has not made them available at high resolution. However, using the low-resolution previews as overlays indicates that at least five of the new wells were present during that time. One of these, the northernmost new (green) well in the above figures, was seemingly on fire.

Well Done

Shown in the interactive graphic below is the region around a new well seemingly on fire in June of 2006. It was probably in production, as the pipeline to the rest of the Haradh-III network is in place. Move your cursor across the image and left click to view changes in the area from 2004-2009. All of the three producers visible were drilled or flowing at the time of the fire. The 2004 and 2009 images are from high-resolution selections in Google Earth, while the 2006 image is a lower resolution DigitalGlobe image. However, it is still relatively easy to identify changes between the high and low-res cases. Most notable in 2009 is the large number of new gas wells as compared to earlier. This is typical of all of Haradh, as drilling for gas has exceeded that for oil.

Figure 6. One of the added oil producer wells, spewing smoke in June 2006. Mouseover the dates to show 2004 and 2009 views. Click to highlight details. |

Mission Accomplished?

With a flurry of rather glowing articles in the press as well as in technical journals, Saudi Aramco has crowned the Haradh-III project a resounding success. These articles are so consistent in their assessment of the project that it was rather surprising to find that it has required 52 producer wells instead of the claimed 32 and also required 3 additional injectors. A couple extra might be expected, but that so many more were needed and that this has not leaked out is somewhat shocking. What are we to infer from this? Lower production from each well (vs. the claim of 10k b/d)? More total production (i.e. over 300k b/d)? My bet is on the former. This certainly doesn't mean that Haradh-III isn't a significant achievement, but this does suggest that the geological complexity still hasn't been overwhelmed by technology. Saudi Aramco has been scrambling since opening day in early 2006 to meet the 300,000 barrels per day production target, and as of last fall, had at least a couple more wells planned.

Finally, I will note that the latest grand achievement by Saudi Aramco, the Khurais field redevelopment, also suffers from well inflation. When first announced, there were to be a total of 310 wells. When finally started up, there were 420 wells. At they admitted it this time, although no explanation has been offered (perhaps they haven't been asked nicely). Hopefully, Google (GeoEye) will point its new camera at Khurais sometime soon so we may help them count wells.

To browse the well locations using Google Earth, go here.

4 comments:

Many of the new producer wells are very close to locations of the original producing wells. This suggests either there has been a change in completion stratagy or their have been completion problems. For example, perhaps some of the reservoirs were damaged due to poor drilling practices or there are multiple zones that are producing and originally they planned to produce from a single well but changed to multiple wells.

It is not good reservoir management to twin a well to double production, you only twin a well when you have other issues. Well placement is designed to drain volumes of a reservoir.

Some of the new well placement also seems to indicate an improvement of geological understanding where the new wells are positioned to drain a new part of the reservoir, or to compensate for compartmenatalization. The entire reason for the observation wells is to monitor and diagnose these circumstances and take action based on the new understanding, i.e. new wells.

All this says to me (I work on offshore fields) is that the basic geological and resevoir understanding is OK (i.e. the oil is there) but they needed to refine the model a bit and make some adjustments in the actual production scheme.

It is very common in the industry for the intial plan to under estimate the actual hardware requirements, in part because simple geological/reservoir models are assumed (due to lack of inforamtion) and in part because there is a drive to lower costs.

I see nothing unusual here and the field will likely perform as the Saudi's say. It might cost more than they say, but the oil will come out and it will last as long as they say.

Thanks for your thoughts and your perspective.

As I said, I don't believe that Haradh-III is doomed, or that it won't produce 300k b/d for many years. But in your experience, would you lie to your investors or superiors and claim that all of your original wells were working as intended? Costs are certainly important, and if you have to drill 60% more wells because 60% of your MRC laterals had to be shut off due to too much water, and you hadn't planned for that, then that might affect whether or not the production is profitable. For Haradh, there is no doubt that it will be - even if they have to drill a lot more wells. But if you are in deepwater offshore subsalt, it gets dicier.

Saudi Aramco has been studying the geology of Haradh for a long time, with 3D as long as 15 years ago. With geosteering, LWD, etc., the idea was to have a better understanding of the field than is normal. The extra drilling might not be "unusual", but it is certainly different than advertised.

Besides cost and utimate recovery, the other issue of importance for us consumers is flowrate. For example, there is a lot of oil left in northern Ghawar, but it is in thin zones where it hasn't been swept much at all by the water injection. The Berri field is another example in that the oil is there, and they know where it is, but they can't get it out very fast or very economically (or, a least enough to make it a priority over something like Manifa).

It is not beneficial reservoir administration to twin a properly to double production

what worries me is that most wells in southern Ghawar now appear to be gas wells. What is Aramco hiding?

Have a look at what this guy has done;

http://www.oilandgasinfrastructure.com/home/oilandgasmiddleeast/saudi-arabia

Post a Comment